A chit fund is a savings and borrowing scheme practiced in India where a group of individuals come together to contribute a fixed amount every month. This pooled amount is then auctioned each month, and the lowest bidder receives the lump sum, while the remaining amount is distributed among other members after deducting administrative charges.

How do Chit Funds Work?

Once a chit fund is initiated, it must be registered with the appropriate authority, and the foreman (the organizer of the chit fund) is required to deposit 100% of the chit value as a security deposit.

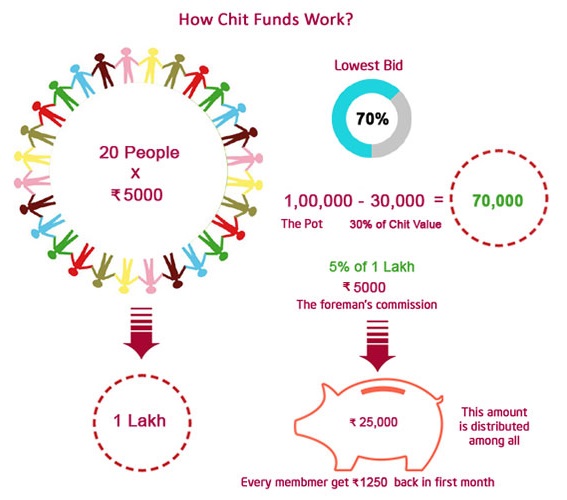

Let’s consider an example for better understanding:

- Chit Value : ₹1,00,000

- Number of Members (n) : 20

- Duration: 20 months

- Monthly Contribution : ₹5,000 per member

- Total Monthly Collection : 20 members × ₹5,000 = ₹1,00,000

Each member must pay their monthly instalment before the auction begins. Only members with no pending dues are eligible to participate in the auction.

The Auction Process

Once the monthly amount of ₹1,00,000 is collected, it is put up for auction among the subscribers. The subscriber who is willing to accept the lowest amount wins the auction and receives that amount as the prize money for the month.

For example, if the lowest bid is 70% of the chit value:

- Winning Amount : ₹70,000

- Balance Amount : ₹1,00,000 – ₹70,000 = ₹30,000

The foreman charges a commission of 5% of the chit value:

- Foreman’s Commission : 5% of ₹1,00,000 = ₹5,000

The remaining ₹25,000 is distributed equally among the 19 other members:

- ₹25,000 ÷ 20 = ₹1,250 per member

Thus, the effective monthly contribution for each member after dividend distribution becomes:

- ₹5,000 – ₹1,250 = ₹3,750

Key Rules

- The auction process continues every month.

- Every subscriber will receive the prize amount exactly once during the chit tenure.

- Only non-prize members can participate in subsequent auctions.

- The cycle repeats until all subscribers have received the prize money.